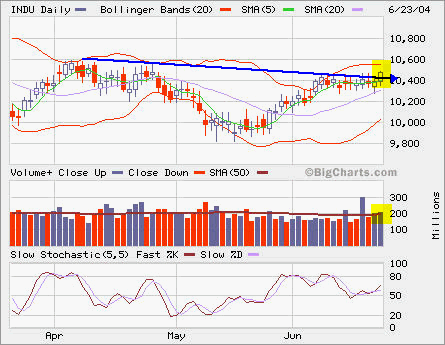

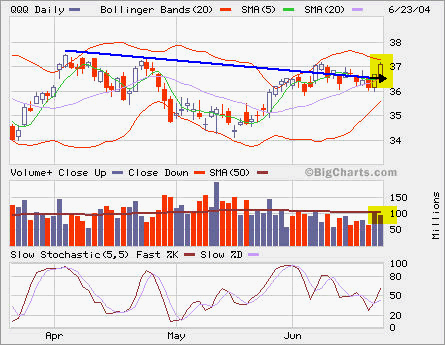

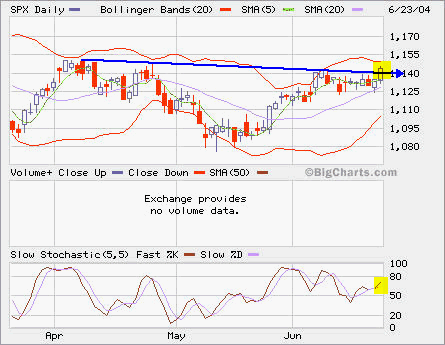

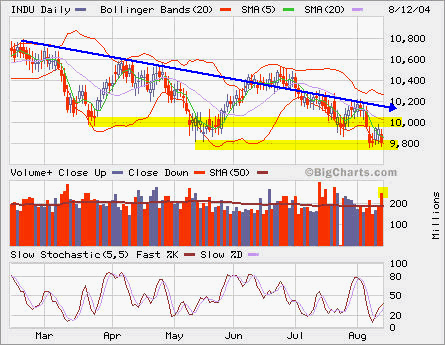

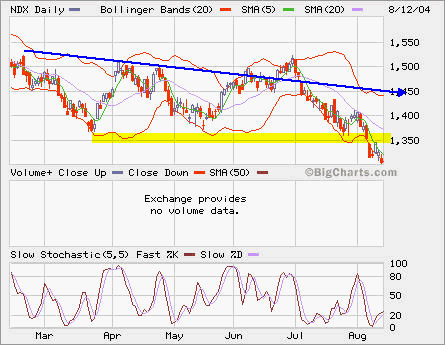

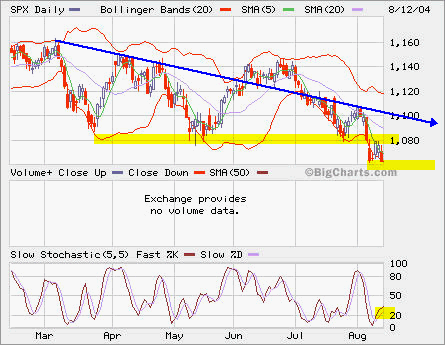

All major indexes broke their support levels and they are all at year low right now. As earning report season is almost over and oil price has hit new high, what would be the triggering point to move market lower?

NDX is at 1300, a major support level. 1050 is the major support for SPX while 9500 is the major support for INDU.

I would be a potential buyer at these support levels for my 401(k) account.

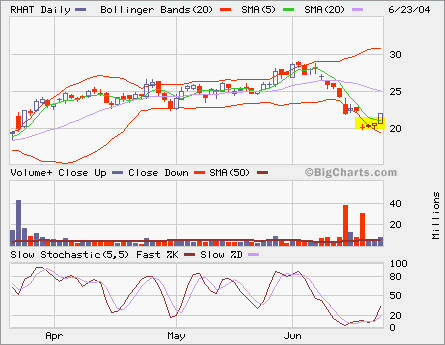

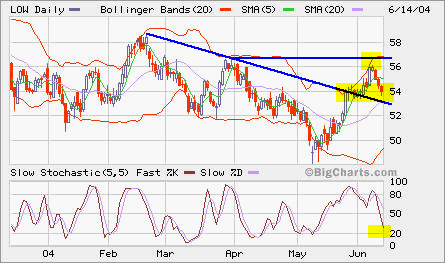

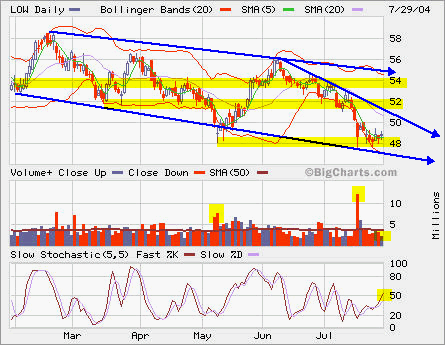

LOW is at its support area. I expect some bounce and may open a small long position on the Sep 50 Calls.

LOW is at its support area. I expect some bounce and may open a small long position on the Sep 50 Calls.