It went just like clock:-).

It went just like clock:-).

Tag Archives: Lfc

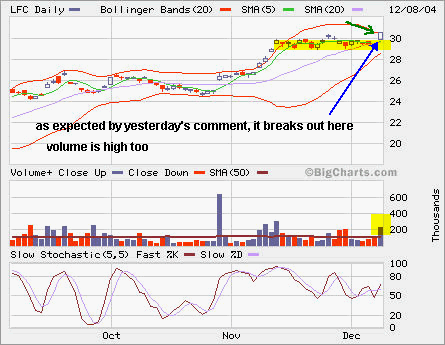

Well, LFC breaks out in high volume …

It went just like clock:-).

It went just like clock:-).

LFC, RHAT and QQQQ

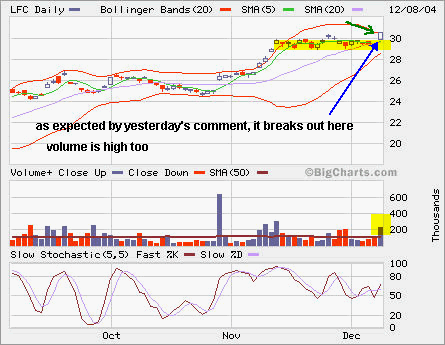

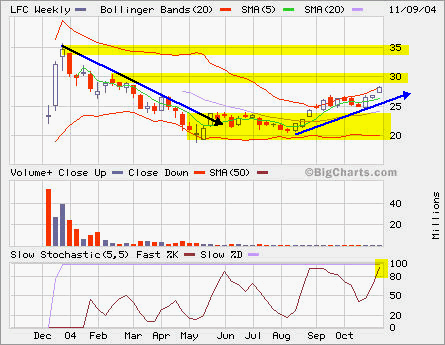

LFC is building a tight base nicely It may break out again.

LFC is building a tight base nicely It may break out again.

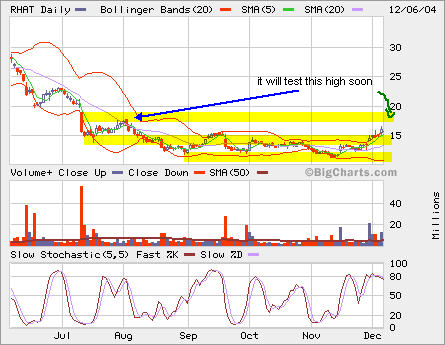

RHAT continues to its move and it’s at the edge of breaking out. I have almost completed my scaling out. I left some money on the table as I underestimated the strength of current move, but I had to lock in some profits when it’s more than 100%! I still hold a few calls on Dec 12.5 (deep ITM) and Dec 15 (ITM).

RHAT continues to its move and it’s at the edge of breaking out. I have almost completed my scaling out. I left some money on the table as I underestimated the strength of current move, but I had to lock in some profits when it’s more than 100%! I still hold a few calls on Dec 12.5 (deep ITM) and Dec 15 (ITM).

QQQQ (its ticker was changed after moving to NASDAQ from AMEX) is at its 3-year high (the comment in the chart was wrong after looking it more carefully) right now although it has not made much move during these four long years! Looking back at those dot com booming years, there is still a long way to go back to its old glory. I should’ve not sold my QQQQ Dec 39 calls though. I’m always nervious when it’s at peak and worried about it’s topping. To work around it, I choose to scale in/out in multiple lots.

QQQQ (its ticker was changed after moving to NASDAQ from AMEX) is at its 3-year high (the comment in the chart was wrong after looking it more carefully) right now although it has not made much move during these four long years! Looking back at those dot com booming years, there is still a long way to go back to its old glory. I should’ve not sold my QQQQ Dec 39 calls though. I’m always nervious when it’s at peak and worried about it’s topping. To work around it, I choose to scale in/out in multiple lots.

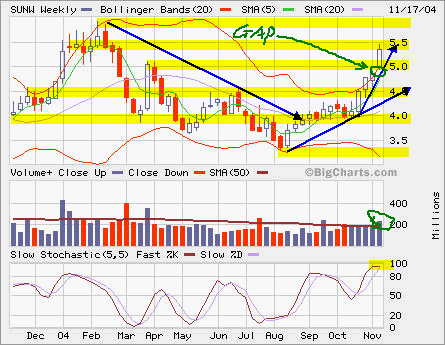

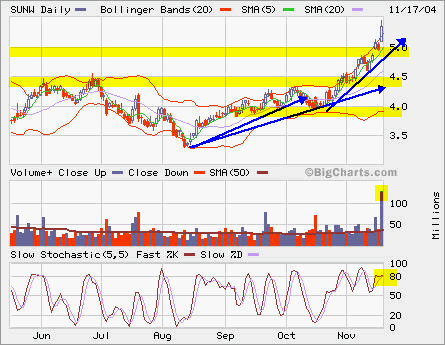

SUNW and LFC

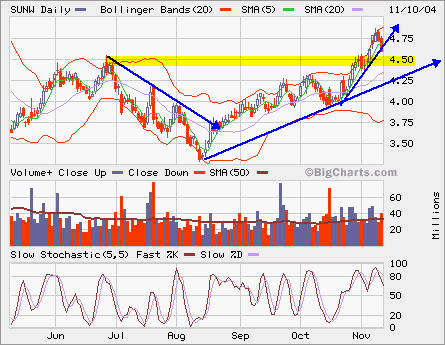

SUNW is moving up quite bit in extremely high volume. It passed through the resistence at 5 and headed to the next one around 5.85, the year’s high.

SUNW is moving up quite bit in extremely high volume. It passed through the resistence at 5 and headed to the next one around 5.85, the year’s high.

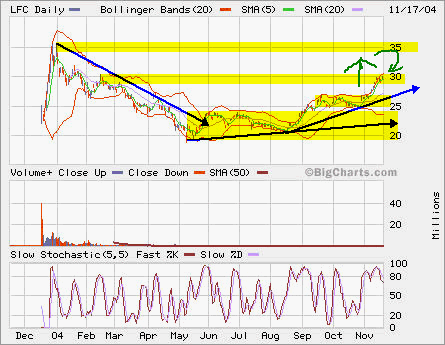

LFC is trying to break out from 30. If it fails to do so, we will see some pullback near the base it built in the past two months. From the chart, getting back to the all time high of 35 is reacheable. It may go sideway before moving to 35 just like it did around the base at 25.

LFC is trying to break out from 30. If it fails to do so, we will see some pullback near the base it built in the past two months. From the chart, getting back to the all time high of 35 is reacheable. It may go sideway before moving to 35 just like it did around the base at 25.

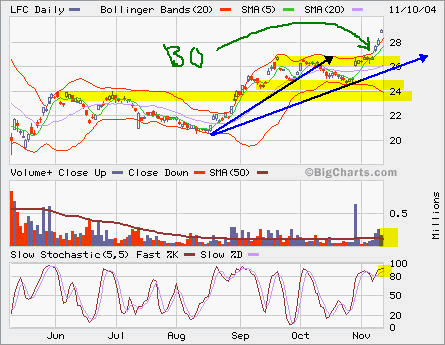

LFC and SUNW

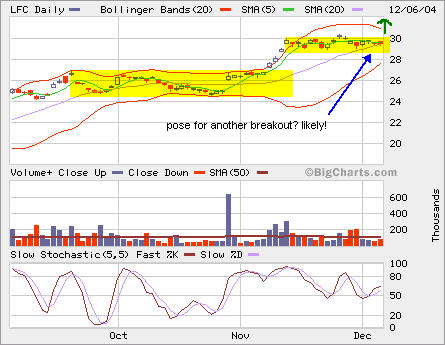

LFC continues to move up since it broke out from base building between 24 and 27. The volume has picked up. It looks like we are heading towards 30 soon. I have sold Dec, Jan and Apr 30 Calls. They may get called away this time.

LFC continues to move up since it broke out from base building between 24 and 27. The volume has picked up. It looks like we are heading towards 30 soon. I have sold Dec, Jan and Apr 30 Calls. They may get called away this time.

SUNW experienced a sudden drop today. It may pull back to 4.5 after steady run-up. I would add some more in my long term account between 4.25 and 4.5.

SUNW experienced a sudden drop today. It may pull back to 4.5 after steady run-up. I would add some more in my long term account between 4.25 and 4.5.