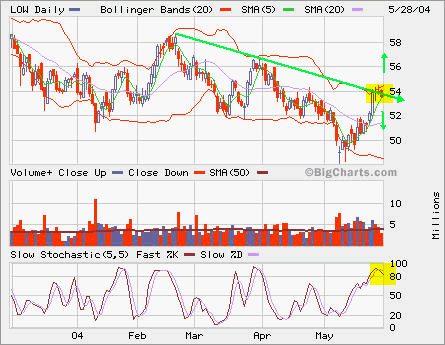

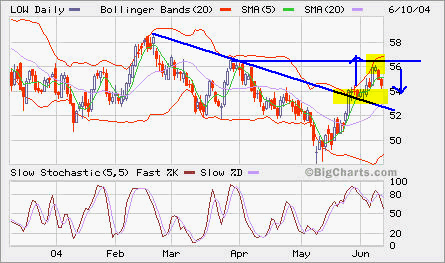

LOW broke out from the downtrend line at 54 last week, but it lost its momentum right at the resistence at 56, which was the previous attempt to break out. I was biased to short at 54 in the last comment on LOW. It would be stopped out at 54.5. It looks like that it is going to retest 54 level before it can go higher. Now, 54 has become the support. The major support is still at 52. I opened a position on LOW Jul 55 Put bought at 1.60. I plan to close it once it hits 54.