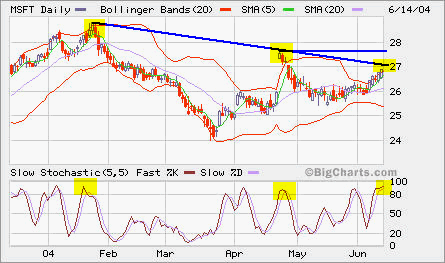

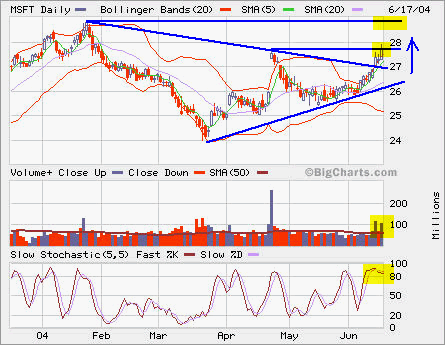

MSFT closed up at 27.77. The intraday high was 27.92 with more than 100M shares changing hands.

It should attempt 28 pretty quick. The resistence is at 28.7 and support is at 26.8. I would not chase it at this moment. You may be able to wait for a pullback to go long around 27.