Dow Jones Industrial tested previous low of 10,800 and bounced back. It has broken out of downtrend and been consolidating around 11,000.

Dow Jones Industrial tested previous low of 10,800 and bounced back. It has broken out of downtrend and been consolidating around 11,000.

Since it’s in summer months, it may not show any determined direction.

Dow Jones Industrial tested previous low of 10,800 and bounced back. It has broken out of downtrend and been consolidating around 11,000.

Dow Jones Industrial tested previous low of 10,800 and bounced back. It has broken out of downtrend and been consolidating around 11,000.

Since it’s in summer months, it may not show any determined direction.

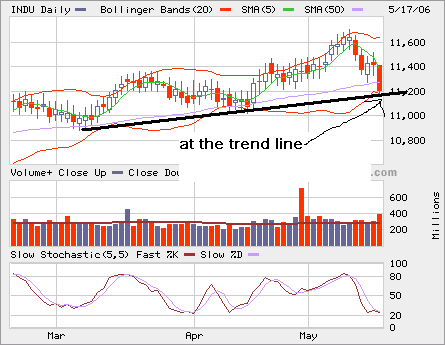

Dow Jones Industrial Average closed at the current uptrend line. Breaking down from here indicates a trend reversal. If you want t0 trade, here’s an opportunity to go long and set a stop loss somewhere below the trend line, say, 11,000.

Dow Jones Industrial Average closed at the current uptrend line. Breaking down from here indicates a trend reversal. If you want t0 trade, here’s an opportunity to go long and set a stop loss somewhere below the trend line, say, 11,000.

Dow Jones Industrail Average lost its momentum and dropped more than 200 points in two days. The supports are shown in the chart. Breach at 11,200 will indicate a trend reversal.

Dow Jones Industrail Average lost its momentum and dropped more than 200 points in two days. The supports are shown in the chart. Breach at 11,200 will indicate a trend reversal.

Dow Jones Industrial Average is matching towards 12,000 again since it reached that level briefly in 2000.

Dow Jones Industrial Average is matching towards 12,000 again since it reached that level briefly in 2000.

It looks more like to break on the upside now. Let’s see if it will follow through rest of this week.

It looks more like to break on the upside now. Let’s see if it will follow through rest of this week.

It’s interesting to notice that crude is at $72/bbl, gold is at $600, while Dow has reached almost multi-year high.