INDU rallied back nicely today. I sold 1/3 of current equity position as planned (10350). Another 1/3 will be sold if Dow Jones reaches 10550-10600.

INDU rallied back nicely today. I sold 1/3 of current equity position as planned (10350). Another 1/3 will be sold if Dow Jones reaches 10550-10600.

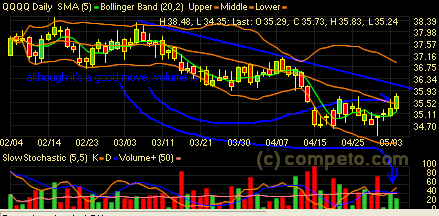

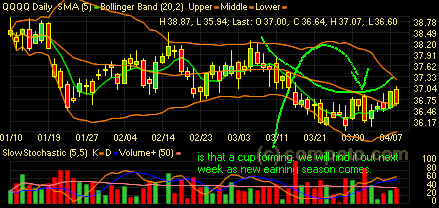

QQQQ is still lagging behind. Today’s move was not accompanied with good volume. Let’s see if we can see some follow through in the rest of week.

QQQQ is still lagging behind. Today’s move was not accompanied with good volume. Let’s see if we can see some follow through in the rest of week.

Tag Archives: Indu

INDU and QQQQ

It looks like every bounce has met with selling, so the SMA 20 becomes the overhead resistence for a while. I plan to reduce 1/3 position if INDU reaches 10350.

It looks like every bounce has met with selling, so the SMA 20 becomes the overhead resistence for a while. I plan to reduce 1/3 position if INDU reaches 10350.

QQQQ looks worse.

QQQQ looks worse.

YHOO, GOOG, MSFT, QQQQ and INDU

YHOO broke out solid this time fueled by good earning report.

YHOO broke out solid this time fueled by good earning report.

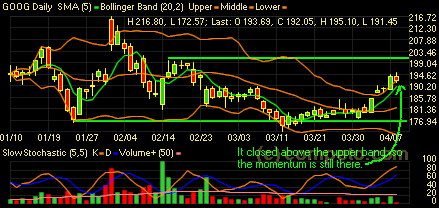

GOOG will be retesting the previous high tomorrow.

GOOG will be retesting the previous high tomorrow.

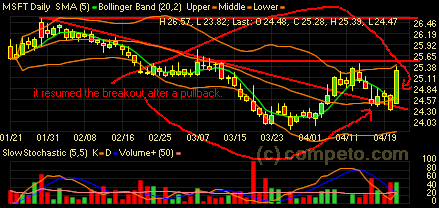

After a pullback, MSFT resumed upward movement from its recent breakout.

After a pullback, MSFT resumed upward movement from its recent breakout.

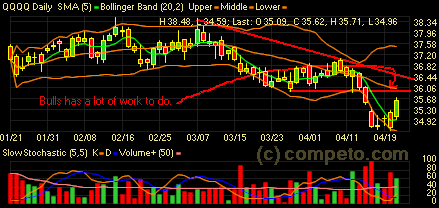

Overall, the tech-heavy QQQQ still has a lot of work ahead.

Overall, the tech-heavy QQQQ still has a lot of work ahead.

INDU faces the resistence around 10388.

INDU faces the resistence around 10388.

INDU, QQQQ and SPX

All markets suffered heavy losses last week. INDU broke its support at 10350 and the new support is above 10000. QQQQ broke the support, we shall see if it continues to decline. SPX is approaching the new support level. All markets are very over sold, but not so good economic data didn’t provide any incentive for buyers to step in. However, my personal view is that the market condition is not too bad, thus there may be a buying opportunity for long term accounts.

All markets suffered heavy losses last week. INDU broke its support at 10350 and the new support is above 10000. QQQQ broke the support, we shall see if it continues to decline. SPX is approaching the new support level. All markets are very over sold, but not so good economic data didn’t provide any incentive for buyers to step in. However, my personal view is that the market condition is not too bad, thus there may be a buying opportunity for long term accounts.

Charts on INDU, GOOG, HNP, QQQQ and LOW

Previous support at 10600 has become the resistence here. All longer term SMAs are pointing downwards, but SMA 5 is pointing sideway or flat. Obviously some good news would help to break the stalemate.

Previous support at 10600 has become the resistence here. All longer term SMAs are pointing downwards, but SMA 5 is pointing sideway or flat. Obviously some good news would help to break the stalemate.

GOOG’s volume has been low. Friday was a down, but volume was very low compared to the up day on Thursday. Not too many sellers and it’s bullish sign.

GOOG’s volume has been low. Friday was a down, but volume was very low compared to the up day on Thursday. Not too many sellers and it’s bullish sign.

Waiting for something to happen here.

Waiting for something to happen here.

Maybe we will see a cup forming here next week or so.

A good entry to long LOW if the support holds. The extremly high selling volume might indicate that most sellers wanted out were out now.

A good entry to long LOW if the support holds. The extremly high selling volume might indicate that most sellers wanted out were out now.