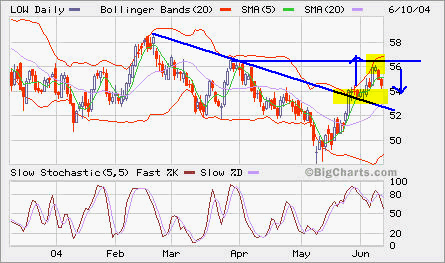

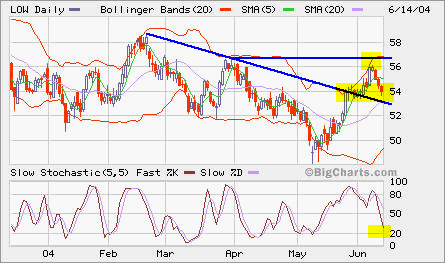

As expected in the last entry, LOW clsoed at 54.01. The intraday low was 53.68. However, the volumne was low. I closed my Jul 55 Put position at 2.00 opened a few days ago.

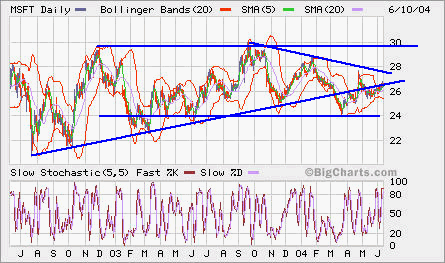

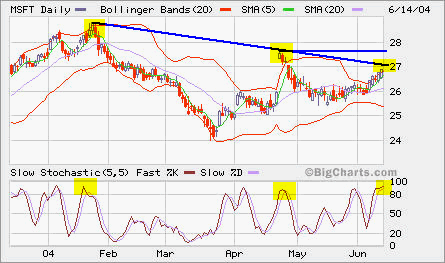

MSFT has been moving up a little bit in spite of declining overall market. If it breaks out from 27.5, it will signal a new attempt of bullish trend since it hit the bottom in March.