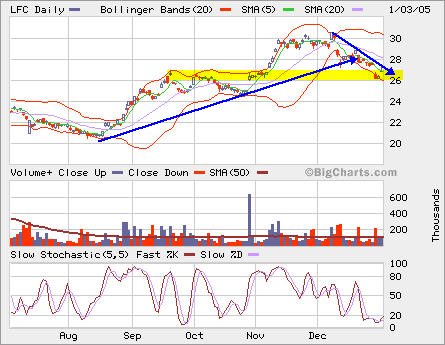

It looks like the slide has stopped. Let’s see if 26 support is held.

It looks like the slide has stopped. Let’s see if 26 support is held.

The uptrend line is still intact. It could go either direction based on earning related acitivities.

The uptrend line is still intact. It could go either direction based on earning related acitivities.

Category Archives: Stocks

LFC, HNP and SUNW

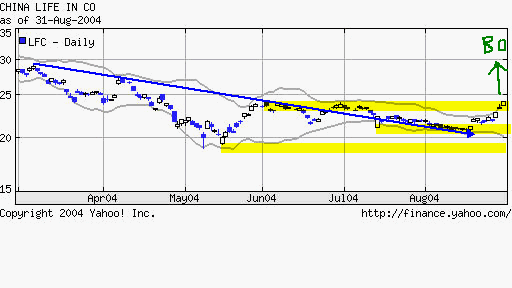

LFC reversed a little bit after it gapped down when the news came out about SEC formal probe.

LFC reversed a little bit after it gapped down when the news came out about SEC formal probe.

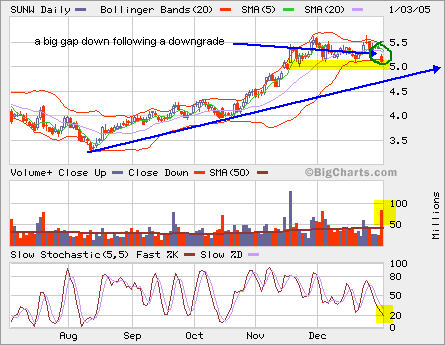

SUNW is under pressure after today’s downgrade. I would close my position if it drops below 5 (It lost over 5% today, previously it’s 25% gain). I was tempting to sell it at 5.5 last week, but changed mind at last minute as I was thinking that it might break out from 5.5. I guess that there were people who were unloading positions around 5.5 to keep it under selling pressure. I would be a buyer again at lower price, say 4.7.

SUNW is under pressure after today’s downgrade. I would close my position if it drops below 5 (It lost over 5% today, previously it’s 25% gain). I was tempting to sell it at 5.5 last week, but changed mind at last minute as I was thinking that it might break out from 5.5. I guess that there were people who were unloading positions around 5.5 to keep it under selling pressure. I would be a buyer again at lower price, say 4.7.

HNP resolved this triangle to the downside.

HNP resolved this triangle to the downside.

CHN

CHN finally reached 35 and closed above 35 yesterday. It has reached my target at 35 and hit my exit limit order set long time ago. 35 is the major resistence level. It’s likely it will pull back. I’m still long-term bullish at CHN and will seek opportunity to get in again. The exit came right before the announced dividend and capital gain distribution date ($3.5701 per share), but I think the market should already factor it in price, so I didn’t cancel the exit. After the ex-div date, the price would adjust to around 32.

CHN finally reached 35 and closed above 35 yesterday. It has reached my target at 35 and hit my exit limit order set long time ago. 35 is the major resistence level. It’s likely it will pull back. I’m still long-term bullish at CHN and will seek opportunity to get in again. The exit came right before the announced dividend and capital gain distribution date ($3.5701 per share), but I think the market should already factor it in price, so I didn’t cancel the exit. After the ex-div date, the price would adjust to around 32.

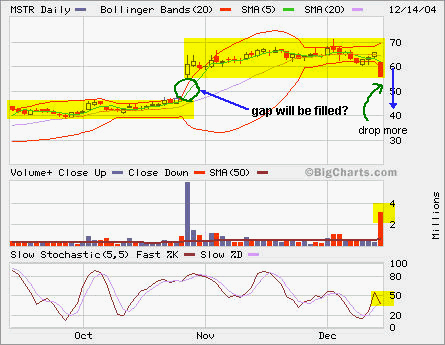

MSTR to fill the gap?

It looks like this gap will be filled soon. On the back of my mind, I was thinking about when to short it, but never acted upon. There is more room to go downward. It’s not in over sold condition yet and the selling pressure is huge based on the volume spike. A lot of catching a falling knife things are going on as every sell had to be matched with a buy!

It looks like this gap will be filled soon. On the back of my mind, I was thinking about when to short it, but never acted upon. There is more room to go downward. It’s not in over sold condition yet and the selling pressure is huge based on the volume spike. A lot of catching a falling knife things are going on as every sell had to be matched with a buy!

LFC

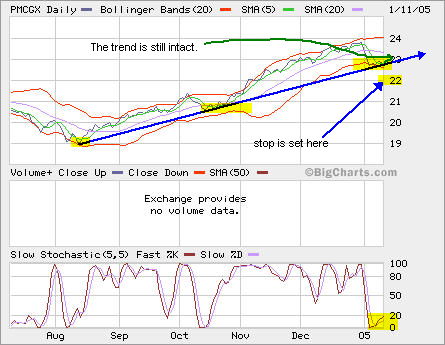

LFC is in breakout mode. It’s been down a lot this year.

LFC is in breakout mode. It’s been down a lot this year.