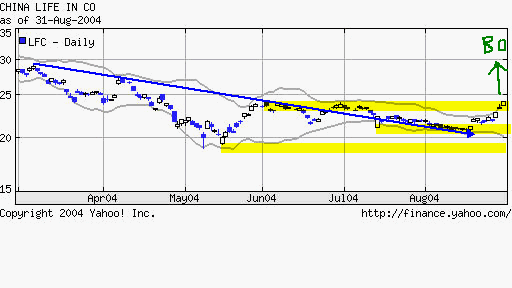

LFC is in breakout mode. It’s been down a lot this year.

LFC is in breakout mode. It’s been down a lot this year.

Category Archives: Stocks

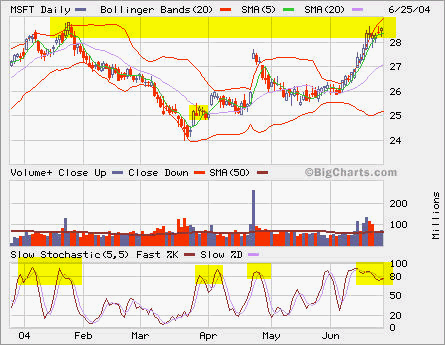

MSFT

MSFT is right at the resistence level. In light of next week feds decision on interest hike, I closed a long position opened at 25.32 on March 26.

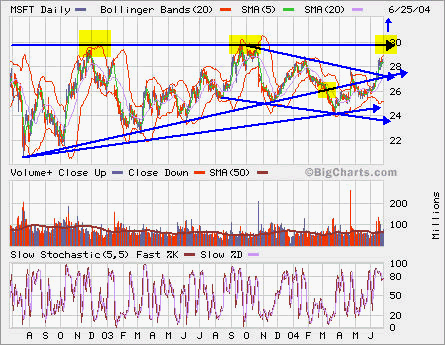

Looking longer term, MSFT has had this breakout from its intermediate-term downtrend and it is approaching the long-term resistence at 30. From the rising triangle, let’s watch if it breaks out to the up side.

MSFT

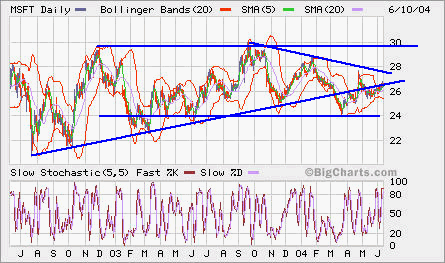

MSFT broke down a little bit from the two year uptrend line in March as seen in this weekly chart. It’s slowly forming a cup. Whether or not it can break out from the intermediate term downtrend remains to be seen in the comming weeks. MSFT has been lagging from its peers. However, with its over $50B in cash and gradually settled legal cases, plus M&A rumors such as SAP, we may see some big movement sson.

MSFT

MSFT went up to above 27 AH. Buying May 27.5 puts is one way to play with the pop.

It’s good opportunity to buy some SIRI. It’s still in the long-term uptrend.

LU

LU is on the rebound. It’s forming a classical cup shape pattern. If it breaks out 5 with high volume, it will start a new phase of uptrend.