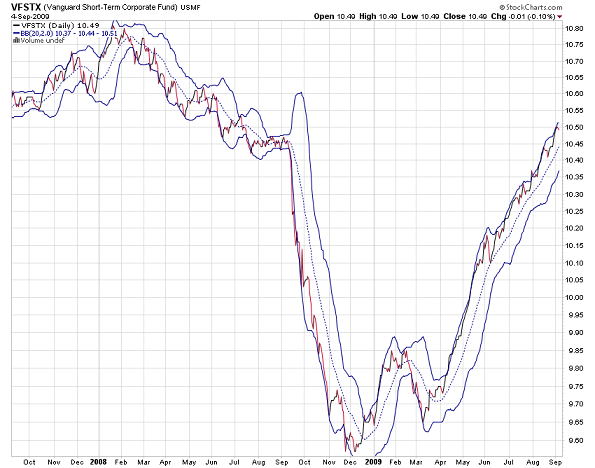

Here we took a look at one of Vanguard Bond Funds: VFSTX. Yield 4.41%; YTD return 10%; investment grade corporate bonds; average maturity 2.6 yr.

It suffered a 10% drop in price in 2008. The actual return was -5%, which was big in short term investment grade bond fund.

What was the cause of that big drop? Client redemption? Maybe considering credit crisis occurred last year. A few bond holdings went under? Maybe too. Had it owned Lehman Brother, for example.

It’s quite interesting that it has a unusual V-shape recovery after the drop. Obviously the relative higher yield has been attracting a lot of investors looking for better returns on their short term investment. Has it also attracted a lot of people who are basically using it as money market funds? Maybe.

Another reason for the recovery might be the valuation of its certain holdings has recovered since the credit crisis.

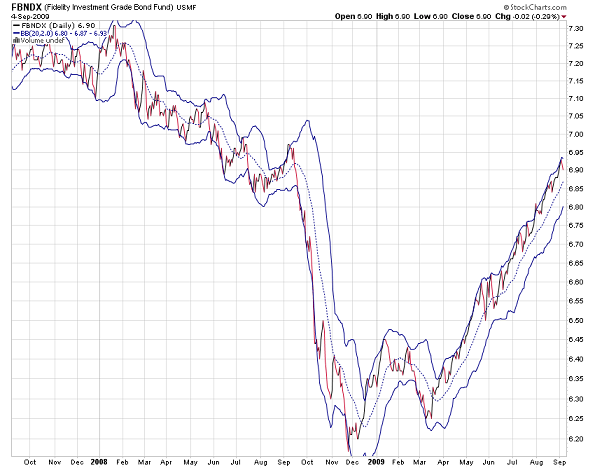

For comparison, here’s Fidelity FBNDX chart, which showed similar drop last year.

If you have owned similar fund, you probably want to pay closer attention to its price movement.

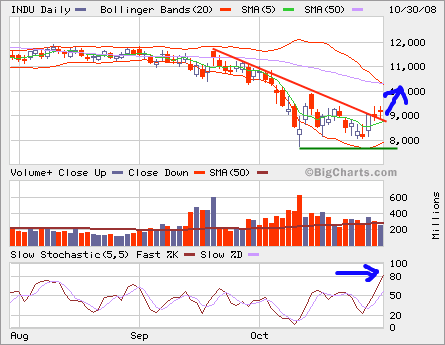

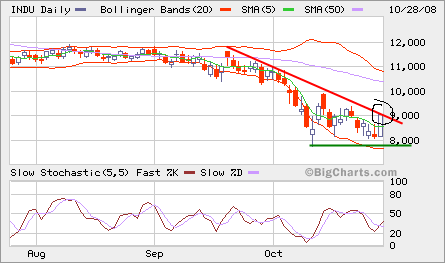

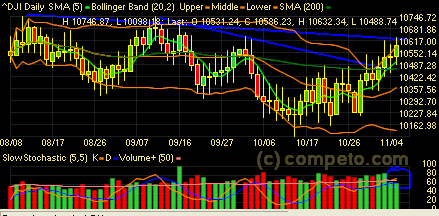

INDU continues moving up crossing SMA 200. Short term wise, it’s overbought.

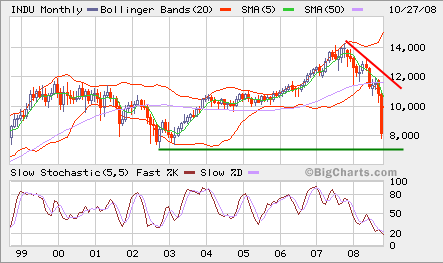

INDU continues moving up crossing SMA 200. Short term wise, it’s overbought.