I did some research on ETFs for fixed income and market exposure in China at ETFConnect. Here’s the list:

TFT – ETF Advisor Trust Treasury 1 Fixed Income Trust Receipts: it can be used as cash equivalent, and currently yields about 1.26%. Edit: I found out today that TFT was closed for liquidation at AMEXTrader.

GCH – Greater China Fund, Inc: Other 6.10%, China 24.60%, Taiwan 30.70% (% for COUNTRY DIVERSIFICATION)

CHN – China Fund: China

5.40%,

United States

7.90%,

Taiwan

33.90%,

Hong Kong

47.10% (too little exposure in China)

JFC – Jardine Fleming China Region Fund: China

24.40%,

Taiwan

26.30%,

Hong Kong

49.10%

TCH – Templeton China World Fund: Taiwan

7.70%,

Hong Kong

34.70%,

China

40.30%

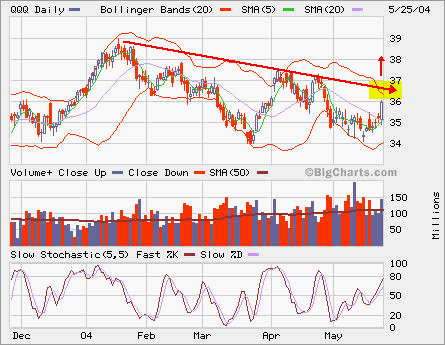

The market moved higher in the morning then gave up most of gains and ended slightly higher. Profit taking maybe …

A lot of selling on MSFT pushed price to drop 0.38 in volume of almost 100 million shares.

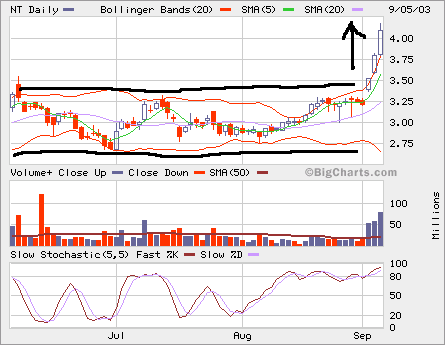

NT broke out from its base and moved up in a hugh way! It’s right at the resistence near 4 and next one at 5. Since the rise is so sharp, locking in the profit now should be priority.

NT broke out from its base and moved up in a hugh way! It’s right at the resistence near 4 and next one at 5. Since the rise is so sharp, locking in the profit now should be priority. Closed puts on QQQ, IBM, SLB and CSCO.

Closed puts on QQQ, IBM, SLB and CSCO.