GOOG is in oversold condition. Both Bollinger Band and Slow Stochastic indicators showed oversold. The dragon fly candle indicates possible reversal.

GOOG is in oversold condition. Both Bollinger Band and Slow Stochastic indicators showed oversold. The dragon fly candle indicates possible reversal.

Tag Archives: Oversold

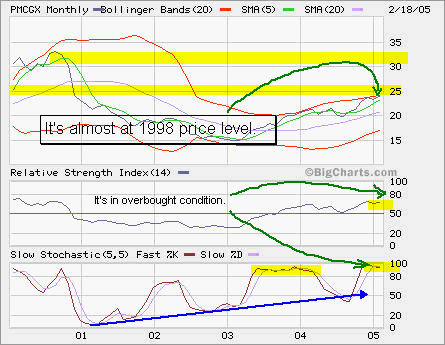

PMCGX back in 1998 level

PMCGX has followed the overall market and resumed its ascending. Currently, it’s in overbought condition indicated by both RSI and Stochastic. As we can see from prior history, the overbought or oversold condition could stay there for a while. I do plan to close or at least to square some money off the table next week as our 401(k) plan will have a week of black out period when the plan is to be adjusted with a few changes. As we all knew from history such as Enron debacle, black out period could be very risky although the mutual funds are much more diversified in this regard. One company imploding would not make a fund to plummet.

PMCGX has followed the overall market and resumed its ascending. Currently, it’s in overbought condition indicated by both RSI and Stochastic. As we can see from prior history, the overbought or oversold condition could stay there for a while. I do plan to close or at least to square some money off the table next week as our 401(k) plan will have a week of black out period when the plan is to be adjusted with a few changes. As we all knew from history such as Enron debacle, black out period could be very risky although the mutual funds are much more diversified in this regard. One company imploding would not make a fund to plummet.

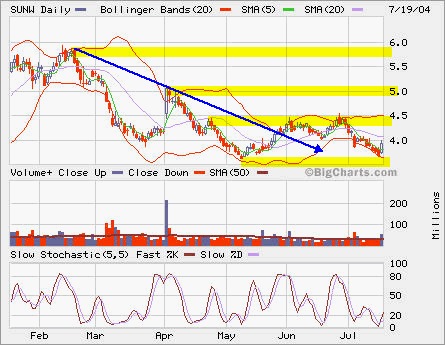

HNP

HNP is forming a triangle here. Which direction will it resolve to? The prevailing trend is down, but it’s been in oversold condition for a month, so I think it will move up from here. How far can it go? I’m not sure. The resistences are at 32 and 34. I may open a small call position on HNP Jan or Feb 30 Calls. Yesterday, the quote for Feb 30 Call was 1.3 x 1.5.

HNP is forming a triangle here. Which direction will it resolve to? The prevailing trend is down, but it’s been in oversold condition for a month, so I think it will move up from here. How far can it go? I’m not sure. The resistences are at 32 and 34. I may open a small call position on HNP Jan or Feb 30 Calls. Yesterday, the quote for Feb 30 Call was 1.3 x 1.5.

Updated:

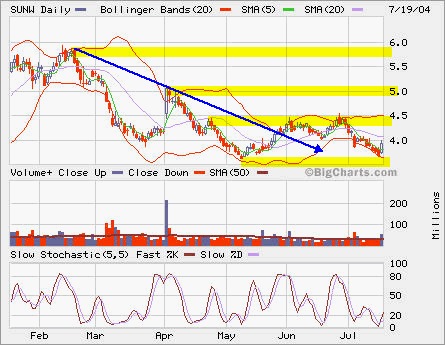

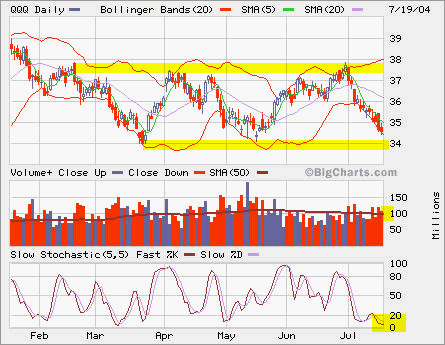

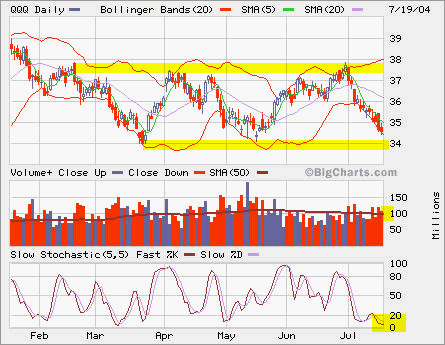

QQQ

Tried to buy QQQ Sep 35 Calls with no fills. Expected to see a bounce as it’s very much oversold.

Tried to buy QQQ Sep 35 Calls with no fills. Expected to see a bounce as it’s very much oversold.

QQQ

Tried to buy QQQ Sep 35 Calls with no fills. Expected to see a bounce as it’s very much oversold.

Tried to buy QQQ Sep 35 Calls with no fills. Expected to see a bounce as it’s very much oversold.