GOOG is at previous low, which is the support. Will it stick, don’t know. The bounce needs some kind of news or rumors. Or MM may stage a shake out to break the support.

GOOG is at previous low, which is the support. Will it stick, don’t know. The bounce needs some kind of news or rumors. Or MM may stage a shake out to break the support.

Tag Archives: News

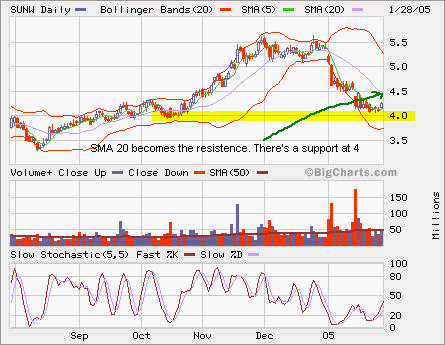

Beaten up SUNW

After suffering a 27% drop in less than a month, SUNW has shown some life above 4. The support at 4 is firming up provided that there is no further major news coming out of SUNW. The next resistence is around 4.5. You may wait for a while before initiating a new position or scale in in increments. The stop loss can be set at 4.0.

After suffering a 27% drop in less than a month, SUNW has shown some life above 4. The support at 4 is firming up provided that there is no further major news coming out of SUNW. The next resistence is around 4.5. You may wait for a while before initiating a new position or scale in in increments. The stop loss can be set at 4.0.

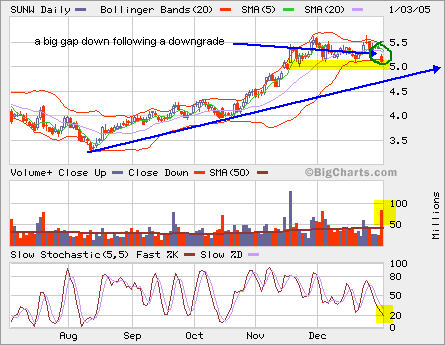

LFC, HNP and SUNW

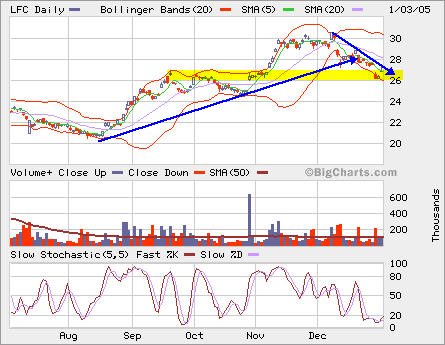

LFC reversed a little bit after it gapped down when the news came out about SEC formal probe.

LFC reversed a little bit after it gapped down when the news came out about SEC formal probe.

SUNW is under pressure after today’s downgrade. I would close my position if it drops below 5 (It lost over 5% today, previously it’s 25% gain). I was tempting to sell it at 5.5 last week, but changed mind at last minute as I was thinking that it might break out from 5.5. I guess that there were people who were unloading positions around 5.5 to keep it under selling pressure. I would be a buyer again at lower price, say 4.7.

SUNW is under pressure after today’s downgrade. I would close my position if it drops below 5 (It lost over 5% today, previously it’s 25% gain). I was tempting to sell it at 5.5 last week, but changed mind at last minute as I was thinking that it might break out from 5.5. I guess that there were people who were unloading positions around 5.5 to keep it under selling pressure. I would be a buyer again at lower price, say 4.7.

HNP resolved this triangle to the downside.

HNP resolved this triangle to the downside.

Some info on stable value funds …

Here’re some facts and links that may help anyone who is researching on stable value funds.

Personally, I put all the cash in my 401(k) into a GIC, which works just like a money market fund as sweep account to trade other mutual funds in the 401(k) account. Currently it yields a little over 4% annually.

Stable Value Funds

OBJECTIVE

Preserve principal and earn a stable rate of return. Their current average yield is around 4%.

PORTFOLIO

Funds own high-quality asset-backed securities, corporate bonds, U.S. Treasuries.

RETURN

Funds have returned 7.19% annually over the past 10 years, vs. 5.28% for money market funds and 8.45% for taxable bond funds.

The links in no particular order:

QQQ Bounces back …

As expected, the good economic news has pushed the market across the board higher today. QQQ closed at 35.34. The volume is higher, but not very high. The resistence is now 36 and support is 34. Interestingly, the intraday high was right below the SMA20, which acted as the resistence at current level. The market is still weak, we shall see if the 34 is the intermediate bottom.