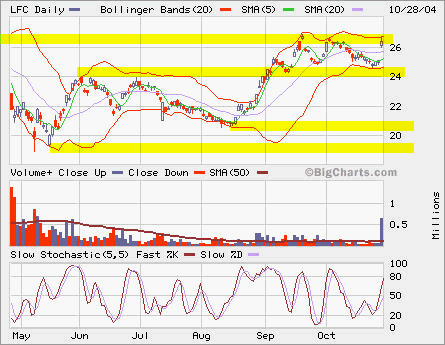

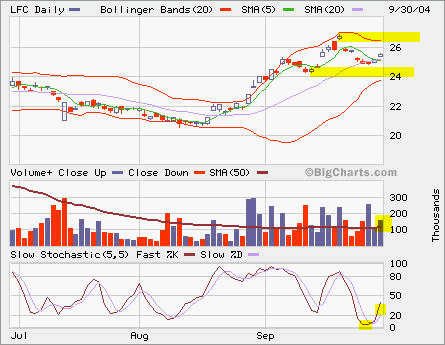

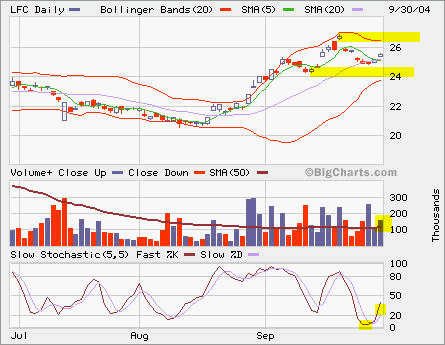

LFC rose 1.33 today in every high volume. It’s testing the overhead resistence again. The next major resistence is at 30.

LFC rose 1.33 today in every high volume. It’s testing the overhead resistence again. The next major resistence is at 30.

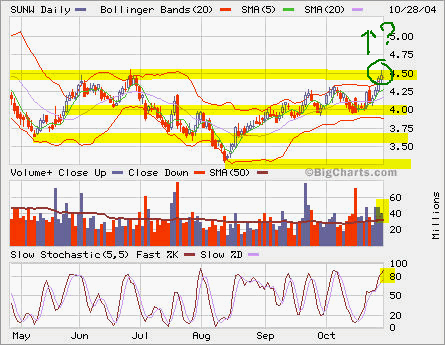

SUNW continued its ascending, but it backed off from 4.54 intraday high and ended at 4.47.

SUNW continued its ascending, but it backed off from 4.54 intraday high and ended at 4.47.

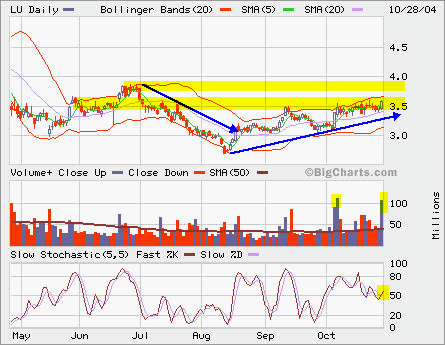

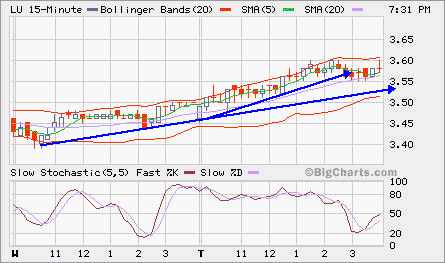

LU was very active traded today, over 100 million shares! It looks like that it’s posing for a breakout. From the two-day 15 minute char, we can see that buying was persistent.

LU was very active traded today, over 100 million shares! It looks like that it’s posing for a breakout. From the two-day 15 minute char, we can see that buying was persistent.

Tag Archives: Lfc

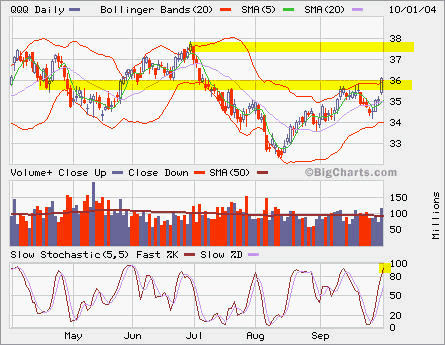

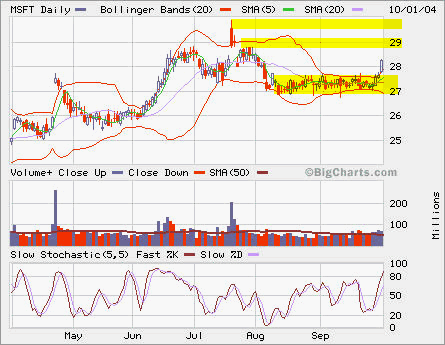

QQQ, MSFT and LFC

QQQ popped up more than 1 point intraday. Sold 1/2 Nov36 calls; also sold short Oct36 calls for 0.55, will cover it at dip. This QQQ position is now changed into an at-the-money calendar spread from previous near-the-money long call only.

QQQ popped up more than 1 point intraday. Sold 1/2 Nov36 calls; also sold short Oct36 calls for 0.55, will cover it at dip. This QQQ position is now changed into an at-the-money calendar spread from previous near-the-money long call only.

MSFT broke out from recent basing mode.

MSFT broke out from recent basing mode.

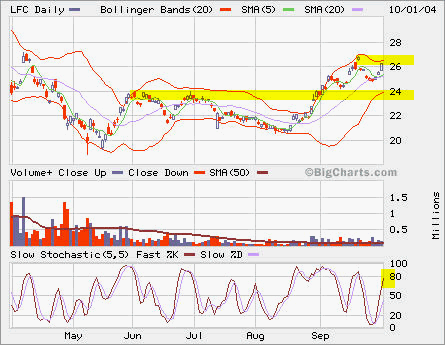

LFC

LFC stayed above 25. It’s good. Added more Nov 25 calls.

LFC stayed above 25. It’s good. Added more Nov 25 calls.

LFC

LFC stayed above 25. It’s good. Added more Nov 25 calls.

LFC stayed above 25. It’s good. Added more Nov 25 calls.

LFC and QQQ

It pulled back again. Judging by the lower volume on the decline, the selling is not panic. Obviously a lot of buying has been done in the past month, but the buyers don’t want to buy higher. This pullback presents a buying opportunity in my view between 24 and 25.

It pulled back again. Judging by the lower volume on the decline, the selling is not panic. Obviously a lot of buying has been done in the past month, but the buyers don’t want to buy higher. This pullback presents a buying opportunity in my view between 24 and 25.

QQQ sits right at 20SMA and in over-sold condition, let’s see if it bounces back next week.

QQQ sits right at 20SMA and in over-sold condition, let’s see if it bounces back next week.