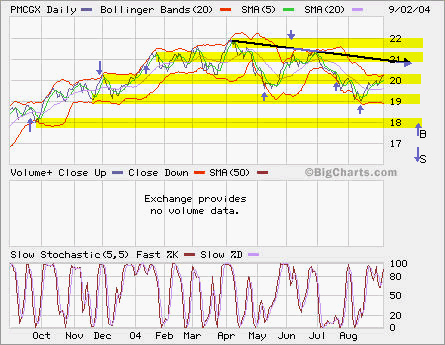

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX YTD performance is -0.05%, my PMCGX YTD is 1.92%.