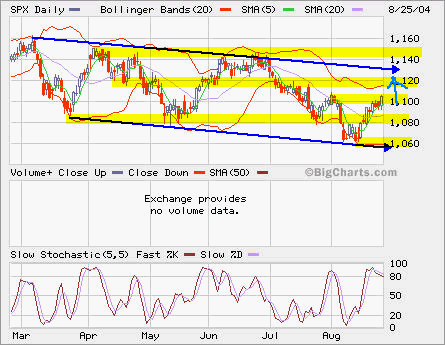

SPX looks like to move up at least to 1120.

SPX looks like to move up at least to 1120.

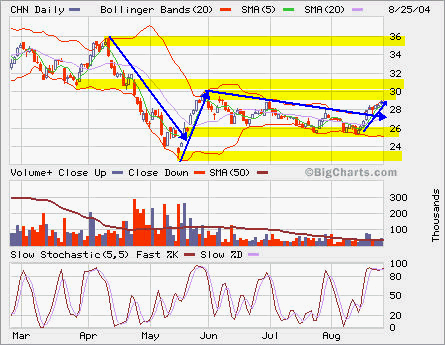

CHN breaks out from its long streak of declines since early April. It will be bullish if it continues to break next resistence at 30.

CHN breaks out from its long streak of declines since early April. It will be bullish if it continues to break next resistence at 30.

Tag Archives: Bullish

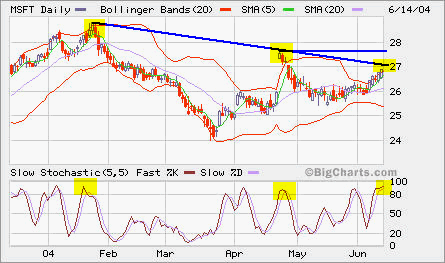

MSFT

MSFT closed at 27.41 with heavy volume. It barely broke out the resistence, but the long candle looks less bullish. Obviously, a lot of people are selling into the pop and the buying demand could not hold up in the close. If tomorrow it has a follow up, it will be very bullish.

You can go long at the breakout or wait for the handle in a typical cup-and-handle case, but the pullback may not happen if it is very strong breakout.

MSFT

MSFT closed at 27.41 with heavy volume. It barely broke out the resistence, but the long candle looks less bullish. Obviously, a lot of people are selling into the pop and the buying demand could not hold up in the close. If tomorrow it has a follow up, it will be very bullish.

You can go long at the breakout or wait for the handle in a typical cup-and-handle case, but the pullback may not happen if it is very strong breakout.

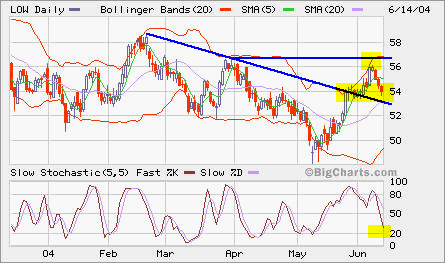

LOW and MSFT

As expected in the last entry, LOW clsoed at 54.01. The intraday low was 53.68. However, the volumne was low. I closed my Jul 55 Put position at 2.00 opened a few days ago.

MSFT has been moving up a little bit in spite of declining overall market. If it breaks out from 27.5, it will signal a new attempt of bullish trend since it hit the bottom in March.

Bounce to 20MA

The 20 MA has become overhead resistence or maybe not. Anyhow, it needs to go over 1500 to be back in bullish mode.