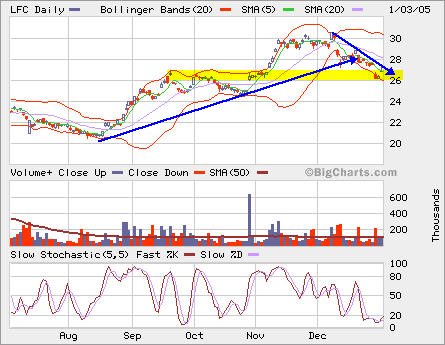

LFC reversed a little bit after it gapped down when the news came out about SEC formal probe.

LFC reversed a little bit after it gapped down when the news came out about SEC formal probe.

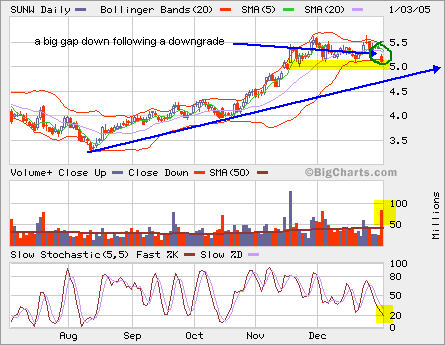

SUNW is under pressure after today’s downgrade. I would close my position if it drops below 5 (It lost over 5% today, previously it’s 25% gain). I was tempting to sell it at 5.5 last week, but changed mind at last minute as I was thinking that it might break out from 5.5. I guess that there were people who were unloading positions around 5.5 to keep it under selling pressure. I would be a buyer again at lower price, say 4.7.

SUNW is under pressure after today’s downgrade. I would close my position if it drops below 5 (It lost over 5% today, previously it’s 25% gain). I was tempting to sell it at 5.5 last week, but changed mind at last minute as I was thinking that it might break out from 5.5. I guess that there were people who were unloading positions around 5.5 to keep it under selling pressure. I would be a buyer again at lower price, say 4.7.

HNP resolved this triangle to the downside.

HNP resolved this triangle to the downside.

Tag Archives: Hnp

HNP

HNP is forming a triangle here. Which direction will it resolve to? The prevailing trend is down, but it’s been in oversold condition for a month, so I think it will move up from here. How far can it go? I’m not sure. The resistences are at 32 and 34. I may open a small call position on HNP Jan or Feb 30 Calls. Yesterday, the quote for Feb 30 Call was 1.3 x 1.5.

HNP is forming a triangle here. Which direction will it resolve to? The prevailing trend is down, but it’s been in oversold condition for a month, so I think it will move up from here. How far can it go? I’m not sure. The resistences are at 32 and 34. I may open a small call position on HNP Jan or Feb 30 Calls. Yesterday, the quote for Feb 30 Call was 1.3 x 1.5.

Updated:

China Stocks took big hit …

LFC took a big hit as its predecessor was found with accounting irregularities. It dropped $2.13 or 7.4%. Other China stocks was also impacted. Increased my LFC position. Also bought CHN. Looking for opp. to buy HNP again.

SUNW went down to 5.12. It needs to stay above 5 level to keep previous uptrend. Otherwise, we shall see it back to 4-4.5 level.

Pullback?

HNP stopped out. SOHU trail changed to 1.5. SUNW stop 3.5. Still holding QQQ Oct 32 PUTS.

NT reversed and dropped a lot.

Pullback?

HNP stopped out. SOHU trail changed to 1.5. SUNW stop 3.5. Still holding QQQ Oct 32 PUTS.

NT reversed and dropped a lot.