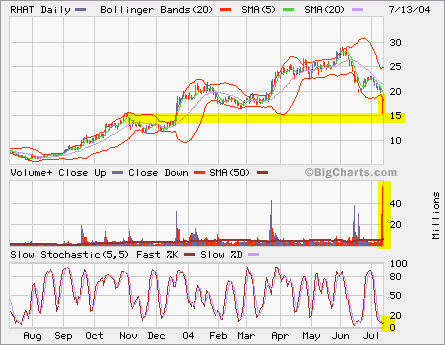

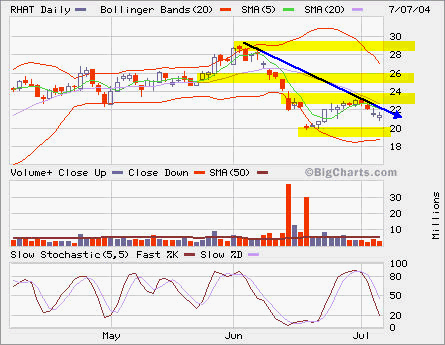

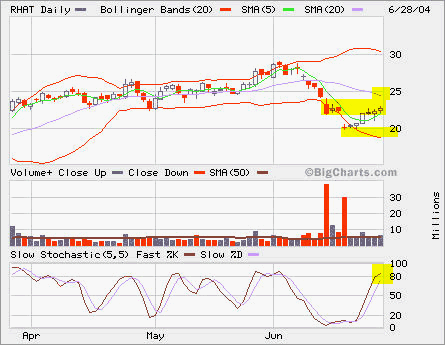

RHAT drops like a rock after it announced that it would change its accounting method to calculate renvenues. I closed all the puts too early, but that’s kind of things hard to predict.

RHAT drops like a rock after it announced that it would change its accounting method to calculate renvenues. I closed all the puts too early, but that’s kind of things hard to predict.

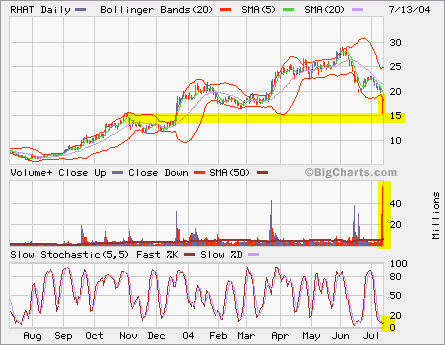

I went long in Aug 17.5 calls at 0.75.

RHAT drops like a rock after it announced that it would change its accounting method to calculate renvenues. I closed all the puts too early, but that’s kind of things hard to predict.

RHAT drops like a rock after it announced that it would change its accounting method to calculate renvenues. I closed all the puts too early, but that’s kind of things hard to predict.

I went long in Aug 17.5 calls at 0.75.

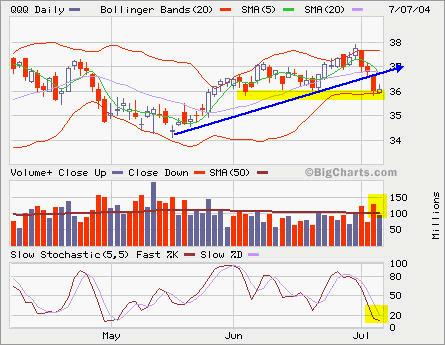

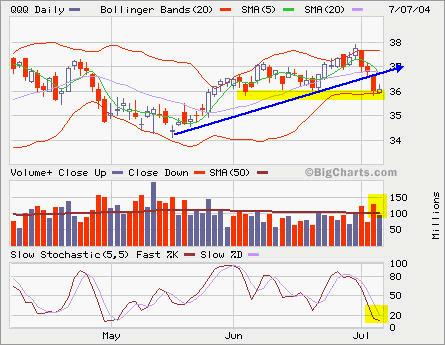

QQQ has broken its uptrend line. Today’s move would look like a dead cat bounce after YHOO lost almost 12% in after-hour trading. Tomorrow will be a big gap down. I have reduced my puts on QQQ.

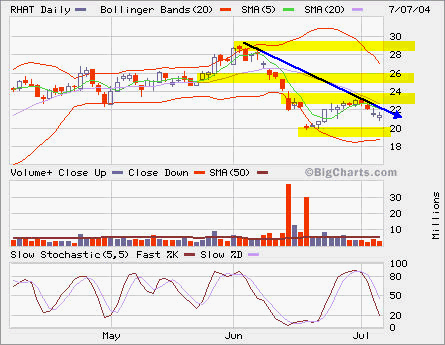

My Jul 20 Puts are under water, but Aug 22.5 Puts are doing OK. I will monitor closely tomorrow to see if I should seize the opportunity to close the Jul 20 Puts.

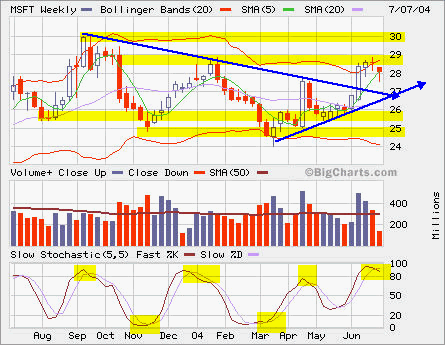

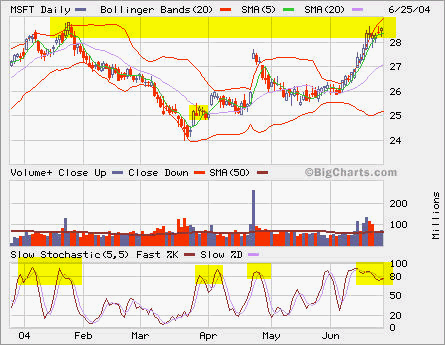

I’m also looking for opportunities to buy back some shares of MSFT for my long-term accounts.

QQQ has broken its uptrend line. Today’s move would look like a dead cat bounce after YHOO lost almost 12% in after-hour trading. Tomorrow will be a big gap down. I have reduced my puts on QQQ.

My Jul 20 Puts are under water, but Aug 22.5 Puts are doing OK. I will monitor closely tomorrow to see if I should seize the opportunity to close the Jul 20 Puts.

I’m also looking for opportunities to buy back some shares of MSFT for my long-term accounts.

RHAT has filled its gap. The gap is the big resistence for it to move through it. I expect that it will come down when the buyers would start selling at break even point after they were trapped by the big gap down! I will long some puts starting from here. The target is 20-21 and stop is 23.5.

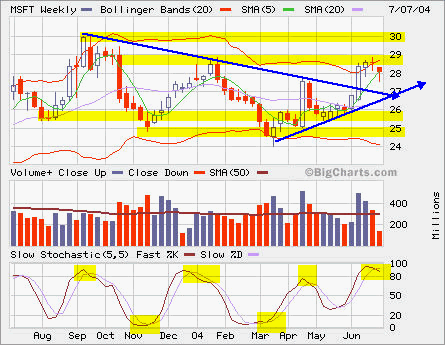

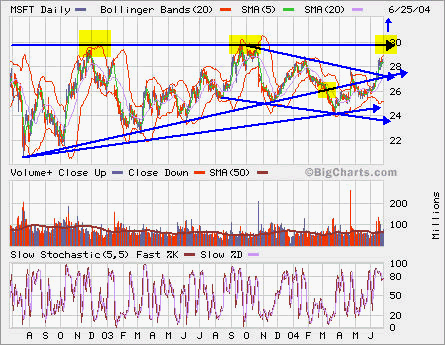

MSFT is right at the resistence level. In light of next week feds decision on interest hike, I closed a long position opened at 25.32 on March 26.

Looking longer term, MSFT has had this breakout from its intermediate-term downtrend and it is approaching the long-term resistence at 30. From the rising triangle, let’s watch if it breaks out to the up side.