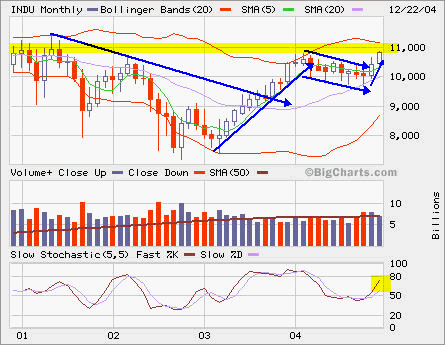

INDU is approaching its major resistence at 11,000. We may hit 11,000 before 2004 ends even we will only have one trading seesion left on the calendar!

INDU is approaching its major resistence at 11,000. We may hit 11,000 before 2004 ends even we will only have one trading seesion left on the calendar!

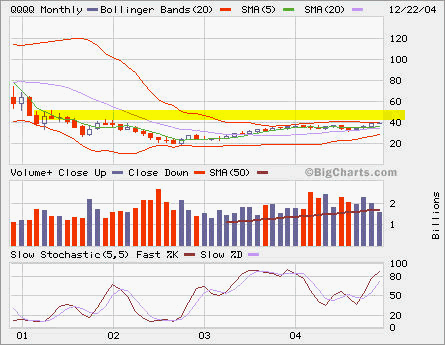

QQQQ has been around 40 a few times, it poses to break through the resistence and leaves this long base built over three years!

QQQQ has been around 40 a few times, it poses to break through the resistence and leaves this long base built over three years!

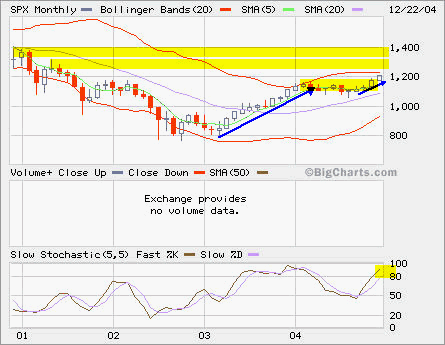

SPX looks more like INDU than QQQQ, but its major resistence is at 13,00 before next one at 1,400, still a long way to go. The trend is up.

SPX looks more like INDU than QQQQ, but its major resistence is at 13,00 before next one at 1,400, still a long way to go. The trend is up.